Blogs

“Third-Party Posts”

HOW ARE ANNUAL RMDS IN THE 10-YEAR PERIOD CALCULATED?

By Ian Berger, JD IRA Analyst In the July 22, 2024 Slott Report, my colleague Sarah Brenner explained how the IRS, in its final SECURE Act required minimum distribution...

REQUIREMENT DURING 10-YEAR RULE STANDS

By Sarah Brenner, JD Director of Retirement Education On July 18, 2024, the IRS issued final required minimum distribution (RMD) regulations under the 2020...

6 Steps to Tune Up Your Retirement Finances

Navigating retirement can be overwhelming given uncertainties like market volatility, inflation, life expectancy and the state of Social Security. Like having a...

Weekly Market Commentary

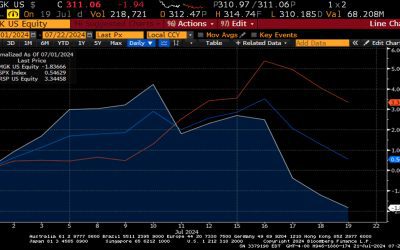

It was a very busy week on Wall Street as investors seemed inclined to rotate out of Mega-cap tech and into this year’s laggards. A failed assassination attempt on...

ROTH CONVERSIONS AND SIMPLE IRA RMDS: TODAY’S SLOTT REPORT MAILBAG

By Ian Berger, JD IRA Analyst Question: One of our clients wants to cash out his IRA and then roll it into a Roth IRA within 60 days. Can this be done directly, or does...

As Social Security’s funds face insolvency, experts say these are key factors to watch

KEY POINTS An improving economy has helped modestly improve the outlook for Social Security’s funds. But experts say the outlook for the program still points to the...

PART 1: INHERITED ROTH IRA BY NON-SPOUSE BENEFICIARY – 5-YEAR CLOCK ISSUES?

By Andy Ives, CFP®, AIF® IRA Analyst When an IRA owner does a Roth conversion, there is typically a 5-year clock for the earnings on the converted dollars to be...

IRS “HYPOTHETICAL RMD RULE” PREVENTS SURVIVING SPOUSES FROM AVOIDING RMDS

By Ian Berger, JD IRA Analyst One of the more interesting rules (if any could be called “interesting”) from the 2022 IRS proposed regulations requires spouse...

Weekly Market Commentary

-Darren Leavitt, CFA US financial markets were able to log another set of all-time highs as investors cheered a weaker-than-anticipated Consumer Price Index report that...

Ed Slott’s Elite IRA Advisor Group (Ed Slott Group) is a membership organization owned by Ed Slott and Company, LLC. Logos and/or trademarks are property of their respective owners and no endorsement of (Northern Financial Alliance) is stated or implied. Ed Slott Group and Ed Slott and Company, LLC are not affiliated with JD Financial Solutions & Insurance Group, Inc..

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

HOW ARE ANNUAL RMDS IN THE 10-YEAR PERIOD CALCULATED?

By Ian Berger, JD IRA Analyst In the July 22, 2024 Slott Report, my colleague Sarah Brenner explained how the IRS, in its final SECURE Act required minimum distribution...

REQUIREMENT DURING 10-YEAR RULE STANDS

By Sarah Brenner, JD Director of Retirement Education On July 18, 2024, the IRS issued final required minimum distribution (RMD) regulations under the 2020...

ROTH CONVERSIONS AND SIMPLE IRA RMDS: TODAY’S SLOTT REPORT MAILBAG

By Ian Berger, JD IRA Analyst Question: One of our clients wants to cash out his IRA and then roll it into a Roth IRA within 60 days. Can this be done directly, or does...

PART 1: INHERITED ROTH IRA BY NON-SPOUSE BENEFICIARY – 5-YEAR CLOCK ISSUES?

By Andy Ives, CFP®, AIF® IRA Analyst When an IRA owner does a Roth conversion, there is typically a 5-year clock for the earnings on the converted dollars to be...

IRS “HYPOTHETICAL RMD RULE” PREVENTS SURVIVING SPOUSES FROM AVOIDING RMDS

By Ian Berger, JD IRA Analyst One of the more interesting rules (if any could be called “interesting”) from the 2022 IRS proposed regulations requires spouse...

INHERITED ROTH IRAS AND QUALIFIED CHARITABLE DISTRIBUTIONS: TODAY’S SLOTT REPORT MAILBAG

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: Do required minimum distributions (RMDs) need to be taken when a non-spouse beneficiary inherits Roth IRA? It...

12 QCD RULES YOU MUST KNOW

By Sarah Brenner, JD Director of Retirement Education If you are charitably inclined and have an IRA, a Qualified Charitable Distribution (QCD) can be a great strategy....

EXCESS CONTRIBUTION FIX: SAME IRA, DIFFERENT DOLLARS

By Andy Ives, CFP®, AIF® IRA Analyst If I pour too much water into a glass, removing liquid from a different glass does not correct the problem. The excess water must...

IRS GIVES GUIDANCE ON PENALTY-FREE WITHDRAWALS FOR FINANCIAL EMERGENCIES AND FOR VICTIMS OF DOMESTIC ABUSE

By Ian Berger, JD IRA Analyst If you take a taxable withdrawal from your IRA or 401(k) (or other company plan) before age 59 ½, you normally have to pay a 10% penalty...